UnitedHealthcare has announced that enrollment is open under Group Policy GA-23111.

From November through December 2018, any individual who is eligible for coverage under one of the GA-23111 plans can enroll and will be accepted for coverage without any medical underwriting or requirement of good health. This includes family members who may not already be covered by the policy.

There are no limitations for pre-existing conditions, and coverage will be effective Jan. 1, 2019.

Only applicants whose completed enrollment forms are postmarked in November or December 2018 will be considered for enrollment.

This enrollment is for former railroad employees (and their dependents) who:

- Were previously covered under any railroad health plan and were represented by a railway labor organization, or

- Were members in accordance with the constitution or bylaws of one of the participating railway labor organizations when coverage under their applicable group health plan ended.

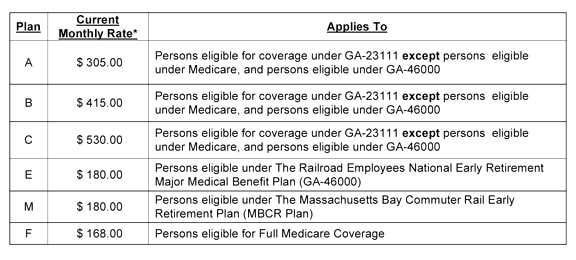

Open enrollment under Plan F is available for railroad employees’ parents or parents-in-law who are eligible under Medicare.

For persons eligible for Medicare, call 800-809-0453 for more information.

For persons not eligible for Medicare, call 800-842-5252 for more information.

To get an enrollment form, visit www.yourtracktohealth.com and follow the “Plan Your Retirement” link at the top of the home page, then visit “Essential Forms” and then “Group Policy GA-23111 Enrollment Form.”

A PDF with more information about GA-23111 is available for download.

An open enrollment period for GA-23111 Plan E also is underway in November and Decemeber.

GA-23111 Plan E is made available by rail labor organizations and pays 70 percent on eligible expenses of the 20 percent not covered under GA-46000, which is the Railroad Employees National Early Retirement Major Medical Benefit plan (ERMA). Combined, GA-46000 and Plan E cover 94 percent of your eligible expenses.

- Plan E has a $100 calendar year deductible per individual.

- Plan E adds an additional lifetime maximum amount of $500,000 for you and each enrolled dependent, which is much higher than for GA-46000 alone

- Plan E has some benefits for routine and/or preventive benefits. For example, covered expenses for pap smears and mammograms are payable in full at 100 percent and not subject to the calendar year deductible. However, the charge for the office visit in connection with the preventive service is not payable under Plan E.

Railroad employees and/or their eligible dependents covered under the national railroad medical, prescription drug, dental, vision, and life insurance benefits plans may now find information about those benefits on a single web page.

Railroad employees and/or their eligible dependents covered under the national railroad medical, prescription drug, dental, vision, and life insurance benefits plans may now find information about those benefits on a single web page.