As a result, certain railroad employers and employees who previously paid railroad retirement taxes based on the exercise of such stock options may be eligible for tax refunds through the Internal Revenue Service (IRS).

Railroad employees and railroad retirement annuitants considering filing for such a tax refund should know that doing so may reduce the amount of their total creditable railroad compensation. Under the Railroad Retirement Act (RRA), creditable compensation is a factor in the computation of a railroad retirement annuity. A reduction in compensation could cause a reduction in an annuitant’s monthly benefit rate, and may result in an overpayment. For active employees, a change in creditable compensation may impact any estimated annuity amounts they were previously given by the Railroad Retirement Board (RRB).

At this time, the RRB is able to provide guidance to only a select group of individuals trying to determine if their total creditable railroad compensation will be reduced and/or if their annuity amounts will change as a result of claiming refunds of taxes paid on non-qualified stock options. That group is comprised of those individuals who have been identified by their railroad employers as employees whose regular earnings met the maximum compensation taxable caps without the inclusion of the stock option payment. In those cases, if the employees file claims for refunds of taxes paid on the stock option payment, payment of the refund will not impact their annuity rate computations. Employees who believe they are members of this group should review their consent letters to confirm whether they have been reported by their employers to be a “Medicare Tax Only” employee. If you are uncertain whether you are a “Medicare Tax Only” employee, please contact your railroad employer. Employees may also call the RRB’s toll-free number at 877-772-5772 if there are any other questions.

The RRB is currently unable to provide guidance to individuals not in the above group. The agency’s three-member board (appointed by the President with the advice and consent of the Senate, and representing rail labor, rail management and the public interest) has the authority to determine what effect, if any, the court’s decision will have on the RRB’s administration of the RRA. However, the position of chairman of the board is currently vacant, and the management member of the board must recuse himself from this issue as he previously worked for a railroad and received non-qualified stock options. The labor member of the board alone lacks statutory authority to make a decision, as a two-member quorum is required by law.

It is expected that in the first quarter of 2019, the agency will get a three-member board in place that will be able to make policy decisions related to this matter. The RRB is currently in discussions with the IRS to determine if it is possible to hold open the period for railroad employees and retirees to file claims for tax refunds until such time as the RRB gets a three-member board in place. The RRB would then be better able to provide information regarding the effect on RRB benefits to those needing assistance.

Read more about how to apply for the refunds and court decision.

Tag: RRB

The following questions and answers provide information about the RRB’s performance in the key areas of retirement applications, survivor applications, disability applications and payments, and railroad unemployment and sickness benefit applications and claims during fiscal year 2018 (October 1, 2017 – September 30, 2018). Included are the customer service performance goals the RRB set for fiscal year 2018. These goals may be revised annually based on such factors as projected workloads and available resources. Also included is information on the RRB’s overall performance, as measured by the timeliness index developed by the agency.

1. How does the RRB measure overall timeliness for customer service?

The RRB developed an index to measure overall timeliness of its customer service in four benefit areas: retirement applications; survivor applications; disability applications and payments; and railroad unemployment and sickness benefit applications and claims. This composite indicator, based on a weighted average, allows for a more concise and meaningful presentation of its customer service efforts in these benefit areas.

2. How timely, overall, was the customer service provided by the RRB in fiscal year 2018, as measured by this timeliness index?

During fiscal year 2018, the overall benefit timeliness index was 98.8 percent. This means that the RRB provided benefit services within the timeframes promised in the customer service plan 98.8 percent of the time. The timeliness index for retirement applications, survivor applications, disability applications and payments only, the processing of which includes considerable manual intervention, is 91.4 percent, whereas the timeliness index for railroad unemployment and sickness benefit applications and claims only, a highly automated process, is 99.9 percent. More detailed performance information for specific benefit areas is presented in the questions and answers that follow.

3. What standards were used by the RRB in fiscal year 2018 for processing applications for Railroad Retirement annuities and how well did it meet those standards?

Under RRB’s standards, if you filed an application for a Railroad Retirement annuity in advance, the RRB will make a decision to pay or deny the application within 35 days of the beginning date of your annuity. If you have not filed in advance, the RRB will make a decision within 60 days of the date you filed your application.

Of the cases processed during fiscal year 2018, the RRB made a decision within 35 days of their annuity beginning dates on 94.9 percent of applicants who filed in advance. The average processing time for these cases was 14.7 days.

Also, of the cases processed during fiscal year 2018, the RRB made a decision within 60 days of their filing dates on 96.5 percent of applicants who had not filed in advance. In these cases, the average processing time was 21.1 days.

The RRB’s goals in fiscal year 2018 were 94 percent timeliness both for persons filing in advance and persons not filing in advance.

4. What standards were used in the area of survivor benefits in fiscal year 2018?

Under the standards, if you filed for a Railroad Retirement survivor annuity and you were not already receiving benefits as a spouse, the RRB will make a decision to pay, deny or transfer your application to the Social Security Administration within 60 days of the beginning date of your annuity or the date the application is filed, whichever is later. If you are already receiving a spouse annuity, the RRB will make a decision to pay, deny or transfer your application for a survivor annuity to the Social Security Administration within 30 days of the first notice of the employee’s death. If you filed for a lump-sum death benefit, the RRB will make a decision to pay or deny your application within 60 days of the date the application is filed.

Of the cases considered during fiscal year 2018, the RRB made a decision within 60 days of the later of the annuity beginning date or the date the application was filed in 96.2 percent of the applications for an initial survivor annuity. In cases where the survivor was already receiving a spouse annuity, a decision was made within 30 days of the first notice of the employee’s death in 96.5 percent of the cases. In addition, a decision was made within 60 days of the date the application was filed in 98.2 percent of the applications for a lump-sum death benefit. The combined average processing time for all initial survivor applications and spouse-to-survivor conversions was 12.95 days. The average processing time for lump-sum death benefit applications was 10.2 days.

The goals for fiscal year 2018 were 94 and 93.5 percent timeliness, respectively, for processing initial survivor applications and spouse-to-survivor conversions. For processing applications for lump-sum death benefits, the goal was 97 percent.

5. What standards were used by the RRB in fiscal year 2018 for processing applications for disability annuities under the Railroad Retirement Act?

Under the customer service plan, if you filed for a disability annuity, the RRB will make a decision to pay or deny a benefit within 100 days of the date you filed your application. If it is determined that you are entitled to disability benefits, you will receive your first payment within 25 days of the date of the RRB’s decision, or the earliest payment date, whichever is later.

Of the cases processed during fiscal year 2018, the RRB made a decision within 100 days of the date an application was filed on 11.3 percent of those filing for a disability annuity. The average processing time was 330.9 days. Of those entitled to disability benefits, 91.5 percent received their first payment within the Customer Service Plan’s time frame. The average processing time was 12.8 days.

The agency’s goals were 70 percent and 93.5 percent timeliness, respectively, for disability decisions and disability payments.

6. What were the standards for the handling of applications and claims for railroad unemployment and sickness benefits and how well did the RRB meet these standards?

Under the standards, if you filed an application for unemployment or sickness benefits, the RRB will release a claim form or a denial letter within 10 days of receiving your application. If you filed a claim for subsequent biweekly unemployment or sickness benefits, the RRB will certify a payment or release a denial letter within 10 days of the date the RRB receives your claim form.

During fiscal year 2018, 99.5 percent of unemployment benefit applications sampled for timeliness and 99.3 percent of sickness benefit applications processed met the RRB’s standard. Average processing times for unemployment and sickness benefit applications were 0.8 and 1.9 days, respectively.

In addition, 99.9 percent of subsequent claims processed for unemployment and sickness benefits met the RRB’s standard for fiscal year 2018. The average processing time for claims was 4.3 days.

The agency’s goals for processing unemployment and sickness applications in fiscal year 2018 were, respectively, 99.5 and 99.3 percent timeliness. The payment or decision goal for subsequent claims was 98 percent timeliness.

7. How did the RRB’s performance in meeting its standards in fiscal year 2018 compare to its performance in fiscal year 2017?

Fiscal year 2018 performance met or exceeded fiscal year 2017 performance in the areas of retirement benefits not filed in advance, spouse-to-survivor conversions, lump-sum death benefit applications, and unemployment and sickness benefit claims.

Average processing times in fiscal year 2018 equaled or improved fiscal year 2017 processing times in the areas of Railroad Retirement applications filed in advance, initial survivor applications, spouse-to-survivor conversions, unemployment applications and unemployment and sickness benefit claims. Also, for fiscal year 2018, the agency met or exceeded all of the customer service performance goals it had set for the year, except in the areas of disability decisions and disability payments.

8. Can beneficiaries provide feedback to the RRB about the service they receive?

A customer assessment survey form allowing beneficiaries to evaluate the service they received and suggest how the agency can improve its service is available in every field office. Persons not satisfied with the service they received may also contact the manager of the office with which they have been dealing.

Tier I and Medicare Tax–The railroad retirement tier I payroll tax rate on covered rail employers and employees for 2019 remains at 7.65 percent. The railroad retirement tier I tax rate is the same as the social security tax, and for withholding and reporting purposes is divided into 6.20 percent for retirement and 1.45 percent for Medicare hospital insurance. The maximum amount of an employee’s earnings subject to the 6.20 percent rate increases from $128,400 to $132,900 in 2019, with no maximum on earnings subject to the 1.45 percent Medicare rate.

An additional Medicare payroll tax of 0.9 percent applies to an individual’s income exceeding $200,000, or $250,000 for a married couple filing a joint tax return. While employers will begin withholding the additional Medicare tax as soon as an individual’s wages exceed the $200,000 threshold, the final amount owed or refunded will be calculated as part of the individual’s Federal income tax return.

Tier II Tax–The railroad retirement tier II tax rates in 2019 will remain at 4.9 percent for employees and 13.1 percent for employers. The maximum amount of earnings subject to railroad retirement tier II taxes in 2019 will increase from $95,400 to $98,700. Tier II tax rates are based on an average account benefits ratio reflecting railroad retirement fund levels. Depending on this ratio, the tier II tax rate for employees can be between 0 percent and 4.9 percent, while the tier II rate for employers can range between 8.2 percent and 22.1 percent.

Unemployment Insurance Contributions–Employers, but not employees, pay railroad unemployment insurance contributions, which are experience-rated by employer. The Railroad Unemployment Insurance Act (RUIA) also provides for a surcharge in the event the Railroad Unemployment Insurance Account balance falls below an indexed threshold amount. The accrual balance of the Railroad Unemployment Insurance Account was $118.1 million on June 30, 2018. Since the balance is less than the indexed threshold of $150.1 million, a 1.5 percent surcharge will be added to the basic contribution rates for 2019, but will not increase the maximum 12 percent rate. There was also a surcharge of 1.5 percent the previous four years, with no surcharge in 2013 and 2014.

As a result, the unemployment insurance contribution rates (including the 1.5 percent surcharge) on railroad employers in 2019 will range from the minimum rate of 2.15 percent to the maximum of 12 percent on monthly compensation up to $1,605, an increase from $1,560 in 2018.

In 2019, the minimum rate of 2.15 percent will apply to 81 percent of covered employers, with 7 percent paying the maximum rate of 12 percent. New employers will pay an unemployment insurance contribution rate of 2.75 percent, which represents the average rate paid by all employers in the period 2015-2017.

1. Would leaving railroad work and accepting a buyout mean that an employee forfeits any future entitlement to an annuity under the Railroad Retirement Act?

As long as an employee has acquired at least 10 years (120 months) of creditable rail service, or 5 years (60 months) of creditable service if such service was performed after 1995, he or she would still be eligible for a regular railroad retirement annuity upon reaching retirement age, or, if totally disabled, for an annuity before retirement age, regardless of whether or not a buyout was ever accepted.

However, if a person permanently leaves railroad employment before attaining retirement age, the employee may not be able to meet the requirements for certain other benefits, particularly the current connection requirement for annuities based on occupational, rather than total, disability and for supplemental annuities paid by the RRB to career employees.

In addition, if an employee does not have a current connection, the Social Security Administration, rather than the RRB, would have jurisdiction of any survivor benefits that become payable on the basis of the employee’s combined railroad retirement and social security covered earnings. The survivor benefits payable by the RRB are generally greater than those paid by the Social Security Administration.

2. How are buyout payments treated under the Railroad Retirement and Railroad Unemployment Insurance Acts?

Buyout payments that result from the abolishment of an employee’s job are creditable as compensation under the Railroad Retirement and Railroad Unemployment Insurance Acts. While the actual names of these employer payments may vary, the treatment given them by the RRB will depend upon whether the employee relinquished or retained his or her job rights. If the employee relinquishes job rights to obtain the compensation, the RRB considers the payment a separation allowance. This compensation is credited to either the month last worked or, if later, the month in which the employee relinquishes his or her employment relationship. While all compensation subject to tier I payroll taxes is considered in the computation of a railroad retirement annuity, no additional service months can be credited after the month in which rights are relinquished.

The RRB considers the buyout payment a dismissal allowance, even though the employer might designate the payment as a separation allowance, if the employee retains job rights and receives monthly payments credited to the months for which they are allocated under the dismissal allowance agreement. This is true even if the employee relinquishes job rights after the end of the period for which a monthly dismissal allowance was paid. However, supplemental unemployment or sickness benefits paid under an RRB-approved nongovernmental plan by a railroad or third party are not considered compensation for railroad retirement purposes.

3. Suppose an employee is given a choice between (1) accepting a separation allowance, relinquishing job rights and having the payment he or she receives credited to one month or (2) accepting a dismissal allowance, retaining job rights and having the payment credited to the months for which it is allocated. What are some of the railroad retirement considerations the employee should keep in mind?

Individual factors such as an employee’s age and service should be considered.

For example, if an employee is already eligible to begin receiving a railroad retirement annuity, he or she may find it advantageous to relinquish job rights, accept a separation allowance, and have the annuity begin on the earliest date allowed by law. Any periodic payments made after that date would not preclude payment of the annuity because the employee has relinquished job rights.

On the other hand, some younger employees may find it more advantageous to retain job rights and accept monthly compensation payments under a dismissal allowance if these payments would allow them to acquire 120 months of creditable rail service (or 60 months of creditable rail service if such service was performed after 1995) and establish future eligibility for a railroad retirement annuity. Also, additional service months might allow a long-service employee to acquire 30 years of service, which is required for early retirement at age 60, or 25 years of rail service, which is required for supplemental annuities paid by the RRB. Establishing 25 years of service could also aid an employee in maintaining a current connection under the Railroad Retirement Act.

4. How would acquiring 25 years of railroad service assist an employee in maintaining a current connection?

The current connection requirement is normally met if the employee has railroad service in at least 12 of the last 30 consecutive months before retirement or death. If an employee does not qualify on this basis but has 12 months of service in an earlier 30-month period, he or she may still meet the requirement if the employee does not work outside the railroad industry in the interval following the 30-month period and the employee’s retirement, or death if that occurs earlier. Nonrailroad employment in that interval will likely break the employee’s current connection.

However, a current connection can be maintained for purposes of supplemental and survivor annuities, but not occupational disability annuities, if the employee completed 25 years of railroad service, was involuntarily terminated without fault from his or her last job in the railroad industry, and did not thereafter decline an offer of employment in the same class or craft in the railroad industry, regardless of the distance to the new position. If all of these requirements are met, an employee’s current connection may not be broken, even if the employee works in regular nonrailroad employment after the 30-month period and before retirement or death. This exception to the normal current connection requirements became effective October 1, 1981, but only for employees still living on that date who left the rail industry on or after October 1, 1975, or who were on leave of absence, on furlough, or absent due to injury on October 1, 1975.

5. Would the acceptance of a buyout have any effect on determining whether an employee could maintain a current connection under the exception provision?

In cases where an employee has no option to remain in the service of his or her employer, the termination of the employment is considered involuntary, regardless of whether the employee does or does not receive a separation or dismissal allowance.

However, an employee who chooses a separation allowance instead of keeping his or her seniority rights to railroad employment would, for railroad retirement purposes, generally be considered to have voluntarily terminated railroad service, and, consequently, would not maintain a current connection under the exception provision.

6. An employee with 25 years of service is offered a buyout with the option of either taking payment in a single lump sum, or receiving monthly payments until retirement age. Could the method of payment affect the employee’s current connection under the exception provision?

If the employee had the choice to remain in employer service and voluntarily relinquished job rights prior to accepting the payments, his or her current connection would not be maintained under the exception provision, regardless of which payment option is chosen. Therefore, nonrailroad work after the 30-month period and before retirement, or the employee’s death if earlier, could break the employee’s current connection. Such an employee could only meet the current connection requirement under the normal procedures.

7. Is it always advantageous to maintain a current connection?

While a current connection is generally advantageous for railroad retirement purposes, the costs of maintaining a current connection could outweigh its value, depending on individual circumstances. There may be other financial or personal factors involved besides railroad retirement eligibility and/or the preservation of a current connection, and these will vary from individual to individual.

8. Are separation and dismissal allowances subject to railroad retirement payroll taxes?

Under the Railroad Retirement Tax Act, which is administered by the Internal Revenue Service, payments of compensation, including most buyouts, are subject to tier I, tier II and Medicare taxes on earnings up to the annual maximum earnings bases in effect when the compensation is paid. This is true whether payment is made in a lump sum or on a periodic basis.

To the extent that a separation allowance does not yield additional tier II railroad retirement service credits, a lump sum, approximating part or all of the railroad retirement tier II payroll taxes deducted from the separation allowance, will be paid upon retirement to employees meeting minimum service requirements or their survivors. This lump sum applies to separation allowances made after 1984.

If an employee receives a dismissal allowance, he or she receives service credits for the tier II taxes deducted from the dismissal allowance payments. Consequently, such a lump sum would not be payable.

If an employee has an option about how a buyout is to be distributed, he or she should consider the impact of both payroll taxes and income tax on the payments. Employees with questions in this regard should contact the payroll department of their railroad employer and/or the Internal Revenue Service.

9. Would an employee be able to receive unemployment or sickness benefits paid by the RRB after accepting a separation allowance?

An employee who accepts a separation allowance cannot receive unemployment or sickness benefits for roughly the period of time it would have taken to earn the amount of the allowance at his or her straight-time rate of pay. This is true regardless of whether the allowance is paid in a lump sum or installments. For example, if an employee’s salary was $3,000 a month without overtime pay and the allowance was $12,000, he or she would be disqualified from receiving benefits for approximately four months.

10. Can an employee receive unemployment benefits after his or her separation allowance disqualification period has ended?

An employee who has not obtained new employment by the end of the disqualification period and is still actively seeking work may be eligible for unemployment benefits at that time. The employee must meet all the usual eligibility requirements, including the availability for work requirement. An employee can establish his or her availability for work by demonstrating a willingness to work and making significant efforts to obtain work. In judging the employee’s willingness to work, the RRB considers, among other factors, the reason the employee accepted the separation allowance and the extent of his or her work-seeking efforts during the disqualification period.

11. How would the acceptance of a dismissal allowance affect an employee’s eligibility for unemployment and sickness benefits?

Payments made under a dismissal allowance would be considered remuneration under the Railroad Unemployment Insurance Act and the employee would not be eligible for unemployment or sickness benefits during the period the dismissal allowance is being paid. The employee may, of course, be eligible for benefits after the end of this period if he or she is still actively seeking work or is unable to work because of illness or injury.

12. Where can employees get more specific information on how benefits payable by the RRB are affected by a buyout?

Employees can get more information online or by phone. Field Office Locator at RRB.gov provides easy access to every field office webpage where the street address and other service information is posted, as well as the option to email an office directly using the feature labeled ‘Send a Secure Message’. The agency’s toll-free number, 1-877-772-5772, is equipped with an automated menu offering a variety of service options, including being transferred to an office to speak with a representative, leave a message, or find the address of a local field office. The agency also maintains a TTY number, 312-751-4701, to accommodate those with hearing or speech impairments. Most RRB offices are open to the public on weekdays from 9:00 a.m. to 3:30 p.m., except on Wednesdays when offices are open from 9:00 a.m. to 12:00 p.m. RRB offices are closed on federal holidays.

Since that adjustment is 2.8 percent in 2019, about 2 million Medicare beneficiaries will see an increase in their Part B premiums but still pay less than $135.50. The standard premium amount will also apply to new enrollees in the program, and certain beneficiaries will continue to pay higher premiums based on their modified adjusted gross income.

The monthly premiums that include income-related adjustments for 2019 will range from $189.60 up to $460.50, depending on the extent to which an individual beneficiary’s modified adjusted gross income exceeds $85,000 (or $170,000 for a married couple). The highest rate applies to beneficiaries whose incomes exceed $500,000 (or $750,000 for a married couple). The Centers for Medicare & Medicaid Services estimates that about 5 percent of Medicare beneficiaries pay the larger income-adjusted premiums.

Beneficiaries in Medicare Part D prescription drug coverage plans pay premiums that vary from plan to plan. Part D beneficiaries whose modified adjusted gross income exceeds the same income thresholds that apply to Part B premiums also pay a monthly adjustment amount. In 2019, the adjustment amount ranges from $12.40 to $77.40.

The Railroad Retirement Board withholds Part B premiums from benefit payments it processes. The agency can also withhold Part C and D premiums from benefit payments if an individual submits a request to his or her Part C or D insurance plan.

The following tables show the income-related Part B premium adjustments for 2019. The Social Security Administration (SSA) is responsible for all income-related monthly adjustment amount determinations. To make the determinations, SSA uses the most recent tax return information available from the Internal Revenue Service. For 2019, that will usually be the beneficiary’s 2017 tax return information. If that information is not available, SSA will use information from the 2016 tax return.

Those railroad retirement and social security Medicare beneficiaries affected by the 2019 Part B and D income-related premiums will receive a notice from SSA by the end of the year. The notice will include an explanation of the circumstances where a beneficiary may request a new determination. Persons who have questions or would like to request a new determination should contact SSA after receiving their notice.

Additional information about Medicare coverage, including specific benefits and deductibles, can be found at www.medicare.gov.

2019 PART B PREMIUMS

Beneficiaries who file an individual tax return with income: | Beneficiaries who file a joint tax return with income: | Income-related monthly adjustment amount | Total monthly Part B premium amount

|

Less than or equal to $85,000 | Less than or equal to $170,000 | $0.00 | $135.50 |

Greater than $85,000 and less than or equal to $107,000 | Greater than $170,000 and less than or equal to $214,000 | $54.10 | $189.60 |

Greater than $107,000 and less than or equal to $133,500 | Greater than $214,000 and less than or equal to $267,000 | $135.40 | $270.90 |

Greater than $133,500 and less than or equal to $160,000 | Greater than $267,000 and less than or equal to $320,000 | $216.70 | $352.20 |

Greater than $160,000 and less than $500,000 | Greater than $320,000 and less than $750,000 | $297.90 | $433.40 |

$500,000 and above | $750,000 and above | $325.00 | $460.50 |

The monthly premium rates paid by beneficiaries who are married, but file a separate return from their spouses and who lived with their spouses at some time during the taxable year, are different. Those rates are as follows:

Beneficiaries who are married, but file a separate tax return, with income: | Income-related monthly adjustment amount | Total monthly Part B premium amount |

Less than or equal to $85,000 | $0.00 | $135.50 |

Greater than $85,000 and less than $415,000 | $297.90 | $433.40 |

$415,000 and above | $325.00 | $460.50 |

The adjusted reduction amount is based on revised projections of benefit claims and payments under the Railroad Unemployment Insurance Act. It will remain in effect through September 30, 2019, the end of the fiscal year. Reductions in future fiscal years, should they occur, will be calculated based on applicable law.

The daily benefit rate is $77, so the 6.2 percent reduction in railroad unemployment and sickness benefits will reduce the maximum amount payable in a 2-week period with 10 days of unemployment from $770.00 to $722.26.

Certain railroad sickness benefits are also subject to regular tier I railroad retirement taxes, resulting in a further reduction of 7.65 percent. Applying the 6.2 percent reduction to these sickness benefits will result in a maximum 2-week total of $667.01.

These reductions are required under the Budget Control Act of 2011 and a subsequent sequestration order to implement the mandated cuts. The law exempted social security benefits, as well as railroad retirement, survivor and disability benefits paid by the RRB, from sequestration.

When sequestration first took effect in March 2013, railroad unemployment and sickness benefits were subject to a 9.2 percent reduction. This amount was then adjusted to 7.2 percent in October 2013, 7.3 percent in October 2014, 6.8 percent in October 2015, 6.9 percent in October 2016, and 6.6 percent in October 2017, as required by law.

In fiscal year 2017, the RRB paid almost $12.6 billion in retirement and survivor benefits to about 548,000 beneficiaries, and net unemployment-sickness benefits of almost $105.4 million to approximately 28,000 claimants.

The following questions and answers describe the current connection requirement and the ways the requirement can be met.

1. How is a current connection determined under the Railroad Retirement Act?

To meet the current connection requirement, an employee must generally have been credited with railroad service in at least 12 months of the 30 months immediately preceding the month his or her railroad retirement annuity begins. If the employee died before retirement, railroad service in at least 12 months in the 30 months before the month of death will meet the current connection requirement for the purpose of paying survivor benefits.

However, if an employee does not qualify on this basis, but has 12 months of service in an earlier 30-month period, he or she may still meet the current connection requirement. This alternative generally applies if the employee did not have any regular employment outside the railroad industry after the end of the last 30-month period which included 12 months of railroad service, and before the month the annuity begins or the date of death.

Once a current connection is established at the time the railroad retirement annuity begins, an employee never loses it, no matter what kind of work is performed thereafter.

2. Can nonrailroad work before retirement break a former railroad employee’s current connection?

Yes. Full or part-time work for a nonrailroad employer in the interval between the end of the last

30-month period including 12 months of railroad service and the month an employee’s annuity begins, or the month of death if earlier, can break a current connection, even where the earnings are minimal.

Self-employment in an unincorporated business will not break a current connection. However, if the business is incorporated the individual is considered to be an employee of the corporation, and such self-employment can break a current connection.

Federal employment with the Department of Transportation, National Transportation Safety Board, Surface Transportation Board, National Mediation Board, Railroad Retirement Board or Transportation Security Administration will not break a current connection. State employment with the Alaska Railroad, as long as that railroad remains an entity of the State of Alaska, will not break a current connection. Also, railroad service in Canada for a Canadian railroad will neither break nor preserve a current connection.

3. Are there any exceptions to these normal procedures for determining a current connection?

A current connection can also be maintained, for purposes of survivor and supplemental annuities, but not for an occupational disability annuity, if the employee completed 25 years of railroad service, was involuntarily terminated without fault from his or her last job in the railroad industry, and did not thereafter decline an offer of employment in the same class or craft in the railroad industry regardless of the distance to the new position.

If all of these requirements are met, an employee’s current connection may not be broken, even if the employee works in regular nonrailroad employment after the 30-month period and before retirement or death. This exception to the normal current connection requirement became effective October 1, 1981, but only for employees still living on that date who left the rail industry on or after October 1, 1975, or who were on leave of absence, on furlough or absent due to injury on October 1, 1975.

4. Would the acceptance of a buy-out have any effect on determining whether an employee could maintain a current connection under this exception provision?

Generally, in cases where an employee has no option to remain in the service of his or her railroad employer, the termination of the employment is considered involuntary, regardless of whether the employee does or does not receive a buy-out.

However, if an employee has the choice of either accepting a position in the same class or craft in the railroad industry or termination with a buy-out, accepting the buy-out is a part of his or her voluntary termination, and the employee would not maintain a current connection under the exception provision.

5. An employee with 25 years of service is offered a buy-out with the option of either taking payment in a single lump sum or of receiving monthly payments until retirement age. Could the method of payment affect the employee’s current connection under the exception provision?

The employee must always relinquish job rights in order to accept the buy-out, regardless of whether it is paid in a lump sum or in monthly payments. Neither payment option would extend the 30-month period. The determining factor for the exception provision to apply when a buy-out is paid is not the payment option. It is whether or not the employee stopped working involuntarily.

An employee considering accepting a buy-out should also be aware that if he or she relinquishes job rights to accept the buy-out, the compensation cannot be used to credit additional service months beyond the month in which the employee severed his or her employment relation, regardless of whether payment is made in a lump sum or on a periodic basis.

6. What if the buy-out agreement allows the employee to retain job rights and receive monthly payments until retirement age?

The RRB considers the buy-out to be a dismissal allowance. When a monthly dismissal allowance is paid, the employee retains job rights, at least until the end of the period covered by the dismissal allowance. If the period covered by the dismissal allowance continues up to the beginning date of the railroad retirement annuity, railroad service months would be credited to those months. These railroad service months would provide at least 12 railroad service months in the 30 months immediately before the annuity beginning date and maintain a regular current connection. They will also increase the number of railroad service months used in the calculation of the railroad retirement annuity.

7. Could the exception provision apply in cases where an employee has 25 years of railroad retirement coverage and a company reorganization results in the employee’s job being placed under social security coverage?

The exception provision has been considered applicable by the RRB in cases where a 25-year employee’s last job in the railroad industry changed from railroad retirement coverage to social security coverage and the employee had, in effect, no choice available to remain in railroad-retirement-covered service. Such 25-year employees have been deemed to have a current connection for purposes of survivor and supplemental annuities.

8. Where can a person get more specific information on the current connection requirement?

More information is available by visiting the RRB’s website, RRB.gov, or by calling an RRB office toll-free at 1-877-772-5772. Persons can also find the address of the RRB office servicing their area by calling the toll-free number, or by clicking on the Field Office Locator tab at RRB.gov. Most RRB offices are open to the public on weekdays from 9:00 a.m. to 3:30 p.m., except on Wednesdays when offices are open from 9:00 a.m. to 12:00 p.m. RRB offices are closed on Federal holidays.

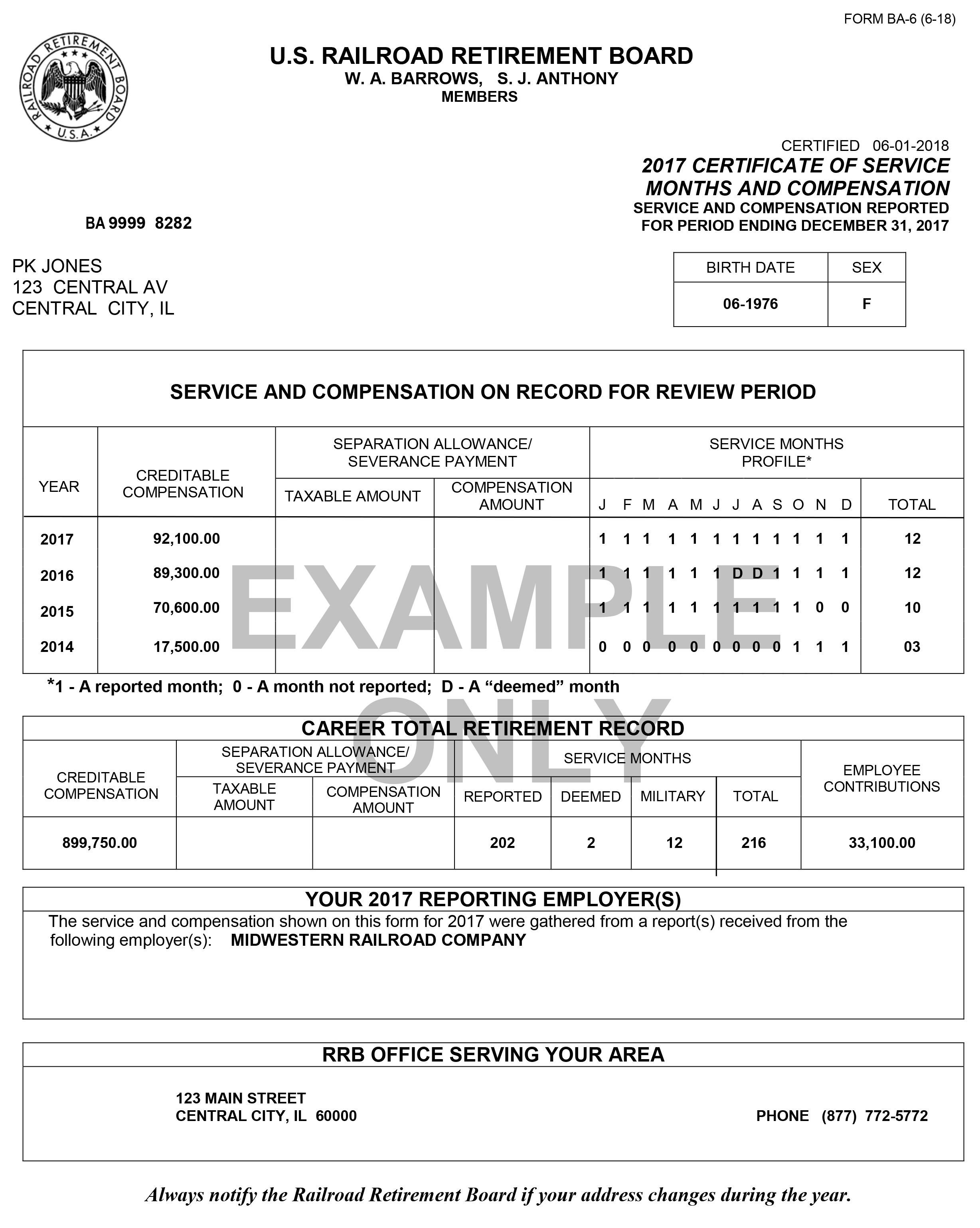

Form BA-6 provides employees with a record of their railroad retirement service and compensation, and the information shown is used to determine whether an employee qualifies for benefits and the amount of those benefits. It is important that employees review their Form BA-6 to see whether their own records of service months and creditable compensation agree with the figures shown on the form.

In checking the 2017 compensation total, employees should be aware that only annual earnings up to $127,200 were creditable for railroad retirement purposes in that year, and that $127,200 is the maximum amount shown on the form. To assist employees in reviewing their service credits, the form also shows service credited on a month-by-month basis for 2016, 2015 and 2014, when the creditable compensation maximum was $118,500 for both 2016 and 2015, and $117,000 for 2014. The form also identifies the employer(s) reporting the employee’s 2017 service and compensation.

Besides the months of service reported by employers, Form BA-6 shows the number of any additional service months deemed by the RRB. Deemed service months may be credited under certain conditions for an employee who did not work in all 12 months of the year, but had creditable tier II earnings exceeding monthly prorations of the creditable tier II earnings maximum for the year. However, the total of reported and deemed service months may never exceed 12 in a calendar year, and no service months, reported or deemed, can be credited after retirement, severance, resignation, discharge or death.

The form also indicates the number of months of verified military service creditable as service under the Railroad Retirement Act, if the service was previously reported to the RRB. Employees are encouraged to submit proofs of age and/or military service in advance of their actual retirement. Filing these proofs with the RRB in advance will streamline the benefit application process and prevent payment delays.

For employees who received separation or severance payments, the section of the form designated “Taxable Amount” shows the amounts reported by employers of any separation allowance or severance payments that were subject to railroad retirement tier II taxes. This information is shown on the form because a lump sum, approximating part or all of the tier II taxes deducted from such payments made after 1984 which did not provide additional tier II credits, may be payable by the RRB upon retirement to qualified employees or to survivors if the employee dies before retirement. The amount of an allowance included in an employee’s regular compensation is shown under “Compensation Amount.”

Form BA-6 also shows, in the section designated “Employee Contributions,” the cumulative amount of tier II railroad retirement payroll taxes paid by the employee over and above tier I social security equivalent payroll taxes. While the RRB does not collect or maintain payroll tax information, the agency computes this amount from its compensation records in order to advise retired employees of their payroll tax contributions for Federal income tax purposes.

Employees should check their name, address, birth date and sex shown at the top of the form. If the form shows the birth date as 99-9999 and the gender code is “U” (for unknown), it means the RRB is verifying his or her social security number with the Social Security Administration. Otherwise, if the personal identifying information is incorrect or incomplete (generally a case where the employee’s surname has more than 10 letters and the form shows only the first 10 letters) or the address is not correct, the employee should contact an RRB field office. The field office can then correct the RRB’s records. This is important in order to prevent identity or security-related problems that could arise if the employee wants to use certain internet services available on the RRB’s website at www.rrb.gov.

Employees may view their railroad retirement service and compensation records; get annuity estimates; apply for or claim railroad unemployment benefits; claim sickness benefits and access their railroad unemployment insurance account statements through the RRB’s website. To use these online services, an employee must set up an RRB online account and obtain a password. Instructions for establishing an online account can be accessed via the “Benefit Online Services” link on the home page. For security purposes, first-time users must enter a Password Request Code (PRC). The agency automatically mails a PRC to any employee who files a paper application for unemployment or sickness benefits. If an individual has not received a PRC, they can request one by clicking the appropriate link on the “Benefit Online Services” page. They will then receive the PRC by mail at their home address in about 10 days.

Employees can also request that printouts of their individual railroad retirement records of service months and compensation be mailed to them. A PIN/Password is not required to use this service. It can be accessed by visiting www.rrb.gov, going to “Benefit Online Services” and then clicking on “No Login Required.”

If the employee’s name was incomplete on Form BA-6, and he or she has not yet contacted an RRB field office to correct it, the employee should enter his or her first and middle initials and his or her surname just as it appears on the Form BA-6 or a previously furnished printout of service and compensation, along with the other requested information, in order to submit an online request.

Any other discrepancies in Form BA-6 should be reported promptly in writing to:

Protest Unit-CESC

U.S. Railroad Retirement Board

844 North Rush Street

Chicago, Illinois 60611-1275

The employee must include his or her social security number in the letter. Form BA-6 also explains what other documentation and information should be provided. The law limits to four years the period during which corrections to service and compensation amounts can be made.

For most employees, the address of the RRB office serving their area is provided on the form along with the RRB’s nationwide toll-free number (1-877-772-5772). RRB field offices are open to the public from 9:00 a.m. to 3:30 p.m. on Monday, Tuesday, Thursday and Friday, and from 9 a.m. to noon on Wednesday, except on federal holidays.

Sample Form BA-6

The U.S. Railroad Retirement Board (RRB) will send out new Medicare cards that do not feature beneficiaries’ Social Security numbers in the coming weeks.

The Medicare Access and CHIP Reauthorization Act of 2015 required the Centers for Medicare and Medicaid Services (CMS) to develop a new card that does not have an individual’s Social Security number on it to cut down on the likelihood of identity theft.

The new Medicare cards instead have a randomly assigned 11-digit combination of numbers and upper-case letters and will no longer indicate the beneficiary’s gender.

When they receive their new Medicare card, beneficiaries should safely and securely destroy their old Medicare card and keep their new Medicare number confidential, the RRB said.

The new card and number will not affect Medicare benefits, and CMS has been working with medical providers to ensure a smooth transition, the RRB said..

A single exception involves people enrolled in a Medicare Advantage Plan, also known as Medicare Part C. These individuals will continue to use their plan’s identification card for access to Medicare benefits as these cards already have a unique identification number.

The RRB said it will mail the new Medicare cards to about 450,000 beneficiaries in early June. A railroad Medicare beneficiary who has a lost or damaged Medicare card can request a new one by calling the RRB at 877-772-5772 or going to the Benefit Online Services section of the agency’s website at www.rrb.gov.

Beneficiaries also can print out a new card at home by setting up an online account at www.mymedicare.gov. This feature will be available after their new card has been mailed.

For additional information, visit www.cms.gov/newcard.

An example of the new Medicare card can be accessed at this link.

1. How are the annuities paid under the Railroad Retirement Act treated under the Federal income tax laws?

A railroad retirement annuity is a single payment comprised of one or more of the following components, depending on the annuitant’s age, the type of annuity being paid, and eligibility requirements: a Social Security Equivalent Benefit (SSEB) portion of tier I, a Non-Social Security Equivalent Benefit (NSSEB) portion of tier I, a tier II benefit, a vested dual benefit, and a supplemental annuity.

In most cases, part of a railroad retirement annuity is treated like a social security benefit for Federal income tax purposes, while other parts of the annuity are treated like private pensions for tax purposes. Consequently, most annuitants are sent two tax statements from the RRB each January, even though they receive only a single annuity payment each month.

2. Which railroad retirement benefits are treated as social security benefits for Federal income tax purposes?

The SSEB portion of tier I (the part of a railroad retirement annuity equivalent to a social security benefit based on comparable earnings) is treated for Federal income tax purposes the same way as a social security benefit. The amount of these benefits that may be subject to Federal income tax, if any, depends on the beneficiary’s income. (To determine if any amount of a SSEB benefit is taxable, please refer to IRS publication 915, Social Security and Equivalent Railroad Retirement Benefits.) If part of a SSEB benefit is taxable, how much is taxable depends on the total amount of a beneficiary’s benefits and other income. Usually, the higher that total amount, the greater the taxable part of a beneficiary’s benefit.

Generally, up to 50 percent of a beneficiary’s benefits will be taxable. However, up to 85 percent of his or her benefits can be taxable if either of the following situations applies.

- The total of one-half of a beneficiary’s benefits and all his or her other income is more than $34,000 ($44,000 if a beneficiary is married filing jointly).

- A beneficiary is married filing separately and lived with his or her spouse at any time during the year.

3. Which railroad retirement benefits are treated like private pensions for Federal income tax purposes?

The NSSEB portion of tier I, tier II benefits, vested dual benefits, and supplemental annuities are all treated like private pensions for Federal income tax purposes. In some cases, primarily those in which early retirement benefits are payable to retired employees and spouses between ages 60 and 62, some occupational disability benefits, and other categories of unique RRB entitlements, the entire annuity may be treated like a private pension. This is because social security benefits based on age and service are not payable before age 62, social security disability benefit entitlement requires total disability, and the Social Security Administration does not pay some categories of beneficiaries paid by the RRB.

4. What information is shown on the railroad retirement tax statements sent to annuitants in January?

One statement, Form RRB-1099 for U.S. citizens or residents (or Form RRB-1042S for nonresident aliens), shows the SSEB portion of tier I or special minimum guaranty payments made during the tax year, the amount of any such benefits that an annuitant may have repaid to the RRB during the tax year, and the net amount of these payments after subtracting the repaid amount.

The amount of any offset for workers’ compensation and the amount of Federal income tax withheld from these payments are also shown. Illustrations and explanations of items found on Form RRB-1099 and Form RRB-1042S can be found in IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits.

The other statement, Form RRB-1099-R (for both U.S. citizens and nonresident aliens), shows the NSSEB portion of tier I, tier II, vested dual benefit, and supplemental annuity paid to the annuitant during the tax year, and may show an employee contribution amount. The NSSEB portion of tier I along with tier II are considered contributory pension amounts and are shown as a single combined amount in the Contributory Amount Paid box (Item 4) on the statement.

The vested dual benefit and supplemental annuity are considered noncontributory pension amounts and are shown as separate items on the statement. The total gross paid amount shown on Form RRB-1099-R is the sum of the NSSEB portion of tier I, tier II, vested dual benefit and supplemental annuity payments. Also shown is the amount of Federal income tax withheld from these payments.

The statement also shows the amount of any of these prior year benefits repaid by the annuitant to the RRB during the tax year. This amount is not subtracted from the gross amounts shown because its treatment depends on the years to which the repayment applies and its taxability in those years. To determine the year or years to which the repayment applies, annuitants should contact the RRB. Illustrations and explanations of items found on Form RRB-1099-R can be found in IRS Publication 575, Pension and Annuity Income.

If the annuitant is taxed as a nonresident alien of the United States, Form RRB-1042S and/or Form RRB-1099-R will show the rate of tax withholding (0 percent, 15 percent or 30 percent) and country of residence for income tax purposes.

Nonresident aliens may receive more than one set of original tax statement Forms RRB-1042S and/or RRB-1099-R in a tax year if there was a change in the country of residence for income tax purposes, or a change in the rate of income tax applied to annuity payments. Nonresident aliens who resided in the United States for part of a tax year may receive a set of original U.S. citizen tax statement Forms RRB-1099 and/or RRB-1099-R and one or more sets of nonresident alien tax statement Forms RRB-1042S and/or RRB-1099-R.

The total Medicare premiums deducted from the railroad retirement annuity may also be shown on either Form RRB-1099 (Form RRB-1042S for nonresident aliens) or Form RRB-1099-R. Medicare premiums deducted from social security benefits paid by the RRB, paid by a third party, or paid through direct billing are not shown on RRB-issued tax statements.

Copy B and/or Copy 2 of Form RRB-1099-R must be submitted with the annuitant’s tax return. Annuitants should retain copy C of all statements for their records, especially if they may be required to verify their income in connection with other Government programs.

5. What is the significance of the employee contribution amount?

For railroad retirement annuitants, the employee contribution amount is considered the amount of railroad retirement payroll taxes paid by the employee that exceeds the amount that would have been paid in social security taxes if the employee’s railroad service had been covered under the Social Security Act.

The employee contribution amount is referred to by the IRS as an employee’s investment, or cost, in the contract. An employee contribution amount is not a payment or income received during the tax year. Only employee and survivor annuitants may have an employee contribution amount shown in Item 3 of their Form RRB-1099-R.

The contributory amount paid (NSSEB portion of tier I and/or tier II) is considered income and is reported to the IRS. The contributory amount paid is either fully taxable or partially taxable depending on whether the employee contribution amount has been used to compute a tax-free (nontaxable) portion of the contributory amount paid. If no employee contribution amount is shown on Form RRB-1099-R, then the contributory amount paid is fully taxable.

The use and recovery of the employee contribution amount is important for annuitants since it affects the amount of taxable income to be reported on income tax returns. There is a tax savings advantage in using (recovering) employee contributions since it may reduce the taxability of the contributory amount paid and in turn the amount of taxable income.

Annuitants should refer to IRS Publication 575, Pension and Annuity Income, and Publication 939, General Rule for Pensions and Annuities, for more information concerning the tax treatment of the contributory amount paid (see questions 6 and 7 below) and use of the employee contribution amount.

6. If an employee contribution amount is shown on my Form RRB-1099-R, may I use the entire amount?

The employee contribution amount shown is attributable to the railroad retirement account number. This means that the employee contribution amount must be shared by all eligible annuitants under that same railroad retirement account number.

If an employee contribution amount is shown on your Form RRB-1099-R and your annuity beginning date is July 2, 1986, or later, you may be able to use some or all of the employee contribution amount shown to compute the nontaxable (tax-free) amount of your contributory amount paid. Therefore, your contributory amount paid and total gross paid shown on your Form RRB-1099-R may be partially taxable.

If an employee contribution amount is not shown on your Form RRB-1099-R, you cannot use or share the employee contribution amount. Therefore, your contributory amount paid and total gross paid shown on your Form RRB‑1099-R are fully taxable.

When more than one annuitant is or was entitled to a contributory amount paid under the same railroad retirement account number, any eligible annuitants may not use the entire employee contribution amount shown on their Form RRB-1099-R for themselves. They must first determine the amount of the total employee contribution amount they are individually entitled to use. That means determining:

- The portion of the total employee contribution amount still potentially available for use, and

- The portion of that amount that must be shared by those eligible annuitants currently receiving contributory amounts paid.

For example, a survivor family group consists of a widow and two full-time students. All three annuitants are eligible to use a portion of the employee contribution amount shown on their Forms RRB-1099-R. They must determine the portion of the employee contribution amount they may each use. Question 7 below provides general information on how to calculate this amount. For more specific information, annuitants should refer to IRS Publication 575, Pension and Annuity Income, and Publication 939, General Rule for Pensions and Annuities.

Any change in the total number of eligible annuitants receiving contributory amounts paid will affect the nontaxable amounts of these annuitants. This change is retroactive to the date on which the number of eligible annuitants changed. Any of these changes could potentially affect the taxable amounts reported to the IRS on prior year income tax returns. Annuitants should determine if any change would require them to file original or amended U.S. Federal income tax returns for prior tax years. For more specific information, annuitants should refer to IRS Publication 575, Pension and Annuity Income, and Publication 939, General Rule for Pensions and Annuities.

7. How are contributory and noncontributory pension amounts taxed?

Amounts shown on Form RRB-1099-R are treated like private pensions and taxed either as contributory pension amounts or as noncontributory pension amounts. The NSSEB portion of tier I and tier II (shown as the contributory amount paid on the statement) are contributory pension amounts. Contributory pension amounts may be fully taxable or partially taxable depending on the presence and use (recovery) of the employee contribution amount. Vested dual benefits and supplemental annuities are considered noncontributory pension amounts. Noncontributory pension amounts are always fully taxable and do not involve the use of the employee contribution amount.

For annuitants with annuity beginning dates before July 2, 1986, the contributory amount paid is fully taxable. These annuitants cannot use the employee contribution amount, even if the amount is shown on Form RRB-1099-R, to compute a nontaxable amount of their contributory amount paid because their employee contribution amount has been fully recovered. Since the contributory amount paid is fully taxable, the total gross pension paid in Item 7 of Form RRB-1099-R is fully taxable.

For annuitants with annuity beginning dates from July 2, 1986, through December 31, 1986, the contributory amount paid may be partially nontaxable for the life of the annuity. These annuitants may be able to use some or all of the employee contribution amount to compute a nontaxable contributory amount paid. Once that nontaxable amount is computed, it does not need to be recomputed and can be used for each tax year unless there is a change in the employee contribution amount, annuity beginning date, date of birth used to determine life expectancy, or the number of eligible annuitants receiving contributory amounts paid. Therefore, the contributory amount paid in Item 4 and the total gross pension paid in Item 7 of Form RRB-1099-R may be partially taxable.

For annuitants with annuity beginning dates effective January 1, 1987, and later, the contributory amount paid may be partially nontaxable for a specified period of time based on life expectancy as determined by IRS actuarial tables. These annuitants may use some or all of the employee contribution amount to compute the nontaxable amount of their contributory amount paid.

Once that nontaxable amount is computed, it does not need to be recomputed and can be used for each tax year unless there is a change in the employee contribution amount, annuity beginning date, date of birth used to determine life expectancy, or the number of eligible annuitants receiving contributory amounts paid. Therefore, the contributory amount paid in Item 4 and the total gross pension paid in Item 7 of Form RRB-1099-R may be partially taxable. However, once the specified life expectancy is met, the employee contribution amount is considered fully recovered, and the contributory amount paid and total gross pension paid are both fully taxable.

The contributory amounts paid of disabled employee annuitants under minimum retirement age are fully taxable and these annuitants cannot use the employee contribution amount. Therefore, the contributory amount paid in Item 4 and the total gross pension paid in Item 7 of Form RRB-1099-R are fully taxable. (Minimum retirement age is generally the age at which individuals could retire based on age and service, which is age 60 with 30 or more years of railroad service or age 62 with less than 30 years of railroad service.)

However, once the disabled employee annuitant reaches minimum retirement age, the annuitant may use the employee contribution amount shown on Form RRB-1099-R to compute the nontaxable amount of his or her contributory amount paid.

The RRB does not calculate the nontaxable amount of the contributory amount paid for annuitants. Annuitants should contact the IRS or their own tax preparer for assistance in calculating the nontaxable amount of their contributory amount paid. For more information on the tax treatment of the contributory amount paid, vested dual benefits, supplemental annuities, the employee contribution amount, and how to use the IRS actuarial tables, annuitants should refer to IRS Publication 939, General Rule for Pensions and Annuities, and IRS Publication 575, Pension and Annuity Income.

8. Does Form RRB-1099-R show the taxable amount of any contributory railroad retirement benefits or just the total amount of such benefits paid during the tax year?

Form RRB-1099-R shows the total amount of any contributory railroad retirement benefits (NSSEB and tier II) paid during the tax year. The RRB does not calculate the taxable amounts. It is up to the annuitant to determine the taxable and nontaxable (tax-free) amounts of the contributory amount paid using the employee contribution amount.

9. Can an employee contribution amount change?

Yes. The employee contribution amount shown on Form RRB-1099-R is based on the latest railroad service and earnings information available on the RRB’s records. Railroad service and earnings information (and the corresponding employee contribution amount) often changes in the first year after an employee retires from railroad service.

That is when the employee’s final railroad service and earnings information is furnished to the RRB by his or her employer. As a result, the employee contribution amount shown on the most recent Form RRB-1099-R may have increased or decreased from a previously-issued Form RRB-1099-R.

Any change in an employee contribution amount is fully retroactive to the railroad retirement annuity beginning date. Therefore, the nontaxable amount of the contributory amount paid should be recomputed.

This could affect the taxable amounts reported to the IRS on prior income tax returns. Generally, an increase in the employee contribution amount is advantageous, as it will yield a larger tax-free amount. However, a decrease in the employee contribution amount may be disadvantageous since it may result in an increased tax liability. In any case, annuitants should determine if any change in their employee contribution amount would require them to file original or amended Federal income tax returns for prior tax years.

10. What if a person receives social security as well as railroad retirement benefits?

Railroad retirement annuitants who also received social security benefits during the tax year receive a Form SSA-1099 (or Form SSA-1042S if they are nonresident aliens) from the Social Security Administration. They should add the net social security equivalent or special guaranty amount shown on Form RRB-1099 (or Form RRB-1042S) to the net social security income amount shown on Form SSA-1099 (or Form SSA-1042S) to get the correct total amount of these benefits. They should then enter this total on the Social Security Benefits Worksheet in the instructions for Form 1040 or 1040A to determine if part of their social security and railroad retirement social security equivalent benefits is taxable income.

Additional information on the taxability of these benefits can be found in IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits.

11. Are the residual lump sums, lump-sum death payments or separation allowance lump-sum amounts paid by the RRB subject to Federal income tax?

No. These amounts are nontaxable and are not subject to Federal income tax. The RRB does not report these amounts on statements.

12. If an annuity was due but unpaid at the time of an annuitant’s death, it may be payable to another person. Would that person be subject to Federal income tax on this annuity?

Yes, if the deceased annuitant would have had to pay Federal income tax on the benefit. The taxable amount of the annuity is reported to the IRS and on Form RRB-1099 (or Form RRB-1042S) or Form RRB-1099-R, as appropriate, which is sent to the person who received the annuity.

13. Are Federal income taxes withheld from railroad retirement annuities?

Yes, and the amounts withheld are shown on the statements issued by the RRB each year. However, an annuitant may request that Federal income taxes not be withheld, unless the annuitant is a nonresident alien or a U.S. citizen living outside the 50 States or Washington, D.C.

Annuitants can voluntarily choose to have Federal income tax withheld from their SSEB payments. To do so, they must complete IRS Form W-4V, Voluntary Withholding Request, and send it to the RRB. They can choose withholding from their SSEB payments at the following rates: 7 percent, 10 percent, 15 percent, or 25 percent.

Annuitants who are taxed as U.S. citizens and who do not live outside the 50 States or Washington, D.C., and wish to have Federal income taxes withheld from their NSSEB and tier II (contributory amount paid), vested dual benefit, and supplemental annuity payments must complete a tax withholding election on Form RRB W-4P, Withholding Certificate For Railroad Retirement Payments, and send it to the RRB. An annuitant is not required to file Form RRB W-4P.

If that form is not filed, the RRB will withhold taxes only if the combined portions of the NSSEB and tier II (contributory amount paid), vested dual benefit and supplemental annuity payments are equal to or exceed an annual threshold amount. In that case, the RRB withholds taxes as if the annuitant were married and claiming three allowances.

14. How is tax withholding applied to the railroad retirement benefits of nonresident aliens?

A nonresident alien is a person who is neither a citizen nor a resident of the United States. Under the Internal Revenue Code, nonresident aliens are subject to a 30-percent tax on income from sources within the United States not connected to a U.S. trade or business. The 30-percent rate applies to all annuity payments exceeding social security equivalent payments and to 85 percent of the annuity portion treated as a social security benefit. The Internal Revenue Code also requires the RRB to withhold the tax.

The tax can be at a rate lower than 30 percent or can be eliminated entirely if a tax treaty between the United States and the country of residence provides such an exemption, and the nonresident alien completes and sends Form RRB-1001, Nonresident Questionnaire, to the RRB. Form RRB-1001 secures citizenship, residency and tax treaty claim information for nonresident beneficiaries (nonresident aliens or U.S. citizens residing outside the United States).

Form RRB-1001 is sent by the RRB to nonresident aliens every three years to renew the claim for a tax treaty exemption. Failure by a nonresident alien to complete Form RRB-1001 will cause loss of the exemption until the exemption is renewed. Such renewals have no retroactivity. Also, a nonresident alien must include his or her United States taxpayer identifying number on Form RRB-1001. Otherwise, any tax treaty exemption claimed on the form is not valid. The majority of nonresident aliens receiving annuities from the RRB are citizens of Canada, which has a tax treaty with the United States.

If a Canadian citizen claims an exemption under the tax treaty, no tax is withheld from the SSEB portion of tier I and a tax withholding rate of 15 percent is applied to the benefit portions treated like pension payments.

Additional information concerning the taxation of nonresident aliens can be found in IRS Publication 519, U.S. Tax Guide for Aliens.

15. Are unemployment benefits paid under the Railroad Unemployment Insurance Act subject to Federal income tax?

All unemployment benefit payments are subject to Federal income tax. Each January, the RRB sends Form 1099-G to individuals, showing the total amount of railroad unemployment benefits paid during the previous year.

16. Are sickness benefits paid by the RRB subject to Federal income tax?

Sickness benefits paid by the RRB, except for sickness benefits paid for on-the-job injuries, are subject to Federal income tax under the same limitations and conditions that apply to the taxation of sick pay received by workers in other industries. Each January, the RRB sends Form W-2 to affected beneficiaries. This form shows the amount of sickness benefits that each beneficiary should include in his or her taxable income.

17. Does the RRB withhold Federal income tax from unemployment and sickness benefits?

The RRB withholds Federal income tax from unemployment and sickness benefits only if requested to do so by the beneficiary. A beneficiary can request withholding of 10 percent of his or her unemployment benefits by filing IRS Form W-4V, Voluntary Withholding Request, with the RRB. A beneficiary can request withholding from sickness benefits by filing IRS Form W-4S, Request for Federal Income Tax Withholding from Sick Pay.

18. Are railroad retirement and railroad unemployment and sickness benefits paid by the RRB subject to State income taxes?

The Railroad Retirement and Railroad Unemployment Insurance Acts specifically exempt these benefits from State income taxes.

19. Can a railroad employee claim a tax credit on his or her Federal income tax return if the employer withheld excess railroad retirement taxes during the year?

If any one railroad employer withheld more than the annual maximum amount, the employee must ask that employer to refund the excess. It cannot be claimed on the employee’s return.

20. Can a railroad employee working two jobs during the year get a tax credit if excess retirement payroll taxes were withheld by the employers?

Railroad employees who also worked for a nonrailroad social security covered employer in the same year may, under certain circumstances, receive a tax credit equivalent to any excess social security taxes withheld.

Employees who worked for two or more railroads during the year, or who had tier I taxes withheld from their RRB sickness benefits in addition to their railroad earnings, may be eligible for a tax credit of any excess tier I or tier II railroad retirement taxes withheld. The amount of tier I taxes withheld from sickness benefits paid by the RRB is shown on Form W-2 issued to affected beneficiaries.

Employees who had tier I taxes withheld from their supplemental sickness benefits (benefits paid under an RRB-approved nongovernmental sickness insurance plan, such as a supplemental sickness benefit plan established by a railroad) may also be eligible for a tax credit of any excess tier I tax.

Such tax credits may be claimed on an employee’s Federal income tax return.

Employees who worked for two or more railroads, received sickness benefits, or had both railroad retirement and social security taxes withheld from their earnings should see IRS Publication 505, Tax Withholding and Estimated Tax, for information on how to figure any excess railroad retirement or social security tax withheld.

###

For more information, visit the RRB’s website at www.rrb.gov.