Railroad Retirement Board (RRB) Labor Member John Bragg announced June 17 that Assistant to the Labor Member Geraldine “Geri” Clark will be retiring July 2 after 51 years with the agency.

“Geri’s retirement is a great loss to my office and the RRB. Her 51 years of dedication to the RRB, rail labor, and to both active and retired rail workers is unmatched. Her self-motivation, commitment to improving customer service and willingness to always go the extra mile when called upon will be greatly missed,” Bragg wrote in a letter announcing Clark’s retirement. “I wish Geri the best as she begins this new chapter in life, but most importantly I want to thank her for her service. She has truly been a pleasure to work with.”

Clark began working at RRB in 1970 and was appointed to her current position in 1985 by former Labor Member of the Board C. J. Chamberlain, becoming the first woman to be named a board assistant in the agency’s history. Geri also served as an assistant to succeeding Labor Members V.M. “Butch” Speakman, Jr. and W.A. “Walt” Barrows.

“Geri’s leaving will mark the end of an era for the Railroad Retirement Board, and I am indebted to her dedication and commitment to the men and women of the rail industry who keep this country moving,” Bragg wrote. “Her work over the last 51 years has helped assure that railroad workers always receive the benefits they need and deserve.”

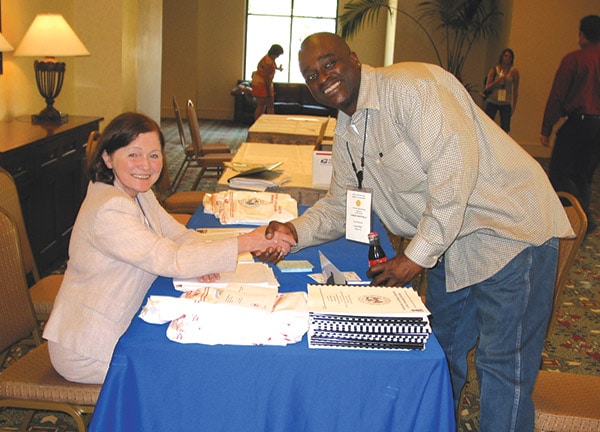

During her time in the Office of the Labor Member, Clark was the driving force behind the Informational Conference program. The conferences were introduced by the Labor Member to help educate local rail labor representatives about the benefits available to members and their families under the Railroad Retirement and Railroad Unemployment Insurance Acts. Thousands of representatives attended conferences over the years and achieved a better understanding of the provisions and financing of the Railroad Retirement and unemployment insurance systems, and of the administrative organization of the RRB. In turn, they helped improve the effectiveness of the agency’s benefit program operations by passing on to their fellow railroad employees the information they acquired at the conferences.

She was a frequent guest at numerous UTU/SMART-TD Regional Meetings, sharing her knowledge of the RRB to members on the cusp of retirement or who were just planning ahead.

More recently Clark spearheaded RRB’s Pre-Retirement Seminar program for workers. The seminars have proven to be a popular successor to the informational conferences, offering similar content, but open to rail labor representatives and also railroad employees and their spouses nearing retirement.

The leadership and the whole of SMART Transportation Division thank Geri Clark for her many decades of excellent service in helping to ensure that union members understand and get the RRB benefits to which they are entitled. We wish her a long, happy and healthy retirement!

Tag: RRB Labor Member John Bragg

Notice from John Bragg, the RRB labor member

Brothers and Sisters,

John Bragg

It is hard to believe that 2020 is in the rearview mirror and we are already approaching the mid-point of 2021. The Railroad Retirement Board (RRB) is still operating in a remote capacity with field offices closed to the public. Hopefully, in the not too distant future, I will be writing to advise you of plans for getting back to normal operations. Today, however, I am writing to share a friendly reminder with you about action which every active employee should take on an annual basis – and may be of particular importance this year to some, in light of the unique work circumstances many encountered.

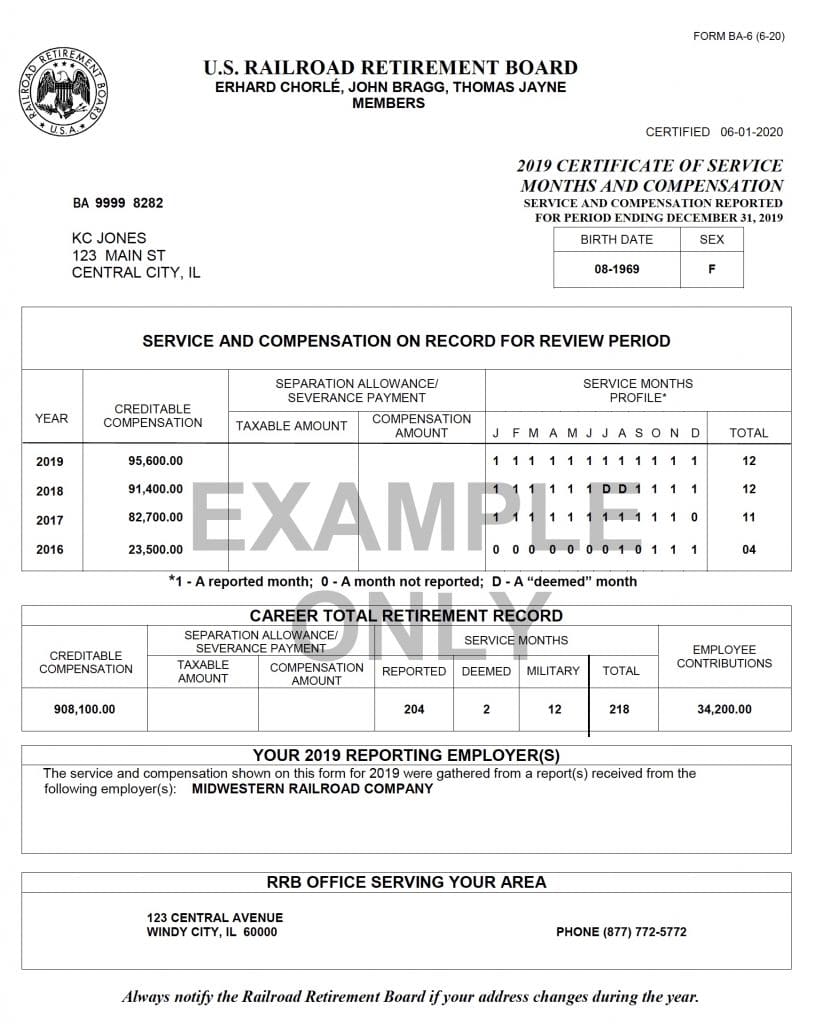

Each year, on or before the last day of February, employers must report service and compensation for each employee who performed compensated service in the preceding calendar year. The RRB, in turn, credits the service and compensation records of individual employees based upon these reports and in June of every year, the RRB releases Form BA-6 to each employee for which compensated service for the preceding year was reported. The Form BA-6 contains the information recently reported for the preceding year, as well as the information reported for three preceding years. For example, the Forms BA-6 which will be released by the RRB in mid-June of 2021 will contain service and compensation reported for the years 2017 through 2020. Regardless of the amount earned, the amount of compensation shown on the Form BA-6 will always be limited by the maximum creditable Tier I compensation amount for the calendar year. For calendar years 2017 through 2020, the maximum amounts creditable are $127,200, $128,400, $132,900 and $137,700, respectively. In addition to showing the creditable compensation for the years 2017 through 2020, the Form BA-6 issued in mid-June of 2021 will show the months for which the employer reported railroad service for the employee during the years 2017-2020.

It is critical that individual employees review their annual Forms BA-6 to make sure that all the information contained on the form is accurate. For example, in addition to validating the creditable compensation, it is important to check to see if the employer properly reported the months for which credit was given by the employer for a month of railroad service. Every month for which you believe you should have credit for railroad service should be coded with a “1”. If the code is “0”, you will not receive credit for any railroad service for that month. If the code is “D” then you will receive credit for railroad service pursuant to the rules governing the deeming of service months.

Employees who received pay for time lost, especially as a result of arbitration proceedings, during the years 2017 through 2020 are reminded of the importance of checking their Forms BA-6. RRB regulations at 20 C.F.R. § 209.15(b) provide that compensation which is pay for time lost must be reported with respect to the year in which the time and compensation were lost. However, it is not uncommon for the individuals responsible for completing reports of service and compensation to be unfamiliar with how to report pay for time lost, or to lack awareness that the compensation they are reporting reflects pay for time lost. As a result, the compensation is mistakenly reported for the year paid AND the service months for which the time and compensation were lost are not credited as railroad service months. Situations where this is most likely to occur are arbitration decisions resulting in the employee being reinstated with all rights and benefits unimpaired and receiving compensation for lost time.

REMEMBER: The law limits the period during which corrections to service and compensation records may be filed to four years from the date the report was due at the RRB, so it is very important for employees to request a correction within that period of time. Any railroad employee who thinks that the Form BA-6 contains an error should be certain to follow the directions on how to file with the RRB a protest of the information contained on the Form BA-6.

RRB Labor Member Press Release:

John Bragg

The Office of the Labor Member is pleased to announce that our 2021 pre-retirement seminar presentation is now available to view online. We designed this program to help educate those nearing retirement about the benefits available to them, and what they can expect during the application process.

This popular program has become a critical resource to RRB customers and employees alike. It helps promote a better understanding of our benefit programs among the railroad community, and in turn, improves the effectiveness of our benefit program operations.

While we typically conduct several seminars across the country annually, we are currently unable to hold in-person events because of COVID-19.

To access the video online, visit RRB.gov/PRS and click on View Pre-Retirement Seminar Presentation. Because we cover several aspects of Railroad Retirement benefits in great detail, the entire presentation is over an hour long. View shorter segments of the program by selecting a seminar topic on the same web page. Available topics include: Retired Employee and Spouse Benefits, Spouse Annuities, Working After Retirement, Survivor Benefits, and Items Affecting All Retirement and Survivor Benefits.

Brothers and Sisters,

As you may have heard, Congress recently enacted legislation to provide some financial relief to railroaders. In the legislation entitled the American Rescue Plan Act of 2021 (ARPA), Congress essentially extended the benefits originally created by the CARES Act. This legislation provides for the following benefits:

- A recovery benefit of $600 per two-week unemployment registration period. This extends the benefit that was established through legislation at the end of December and was due to expire March 14, 2021. As a result, employees receiving unemployment benefits will continue to receive an additional $600 per registration period. This benefit ends with registration periods that begin after September 6, 2021.

- Extended unemployment benefits for employees who have otherwise exhausted benefits. Now, in combination with previous legislation, an additional 200 days within 20 additional consecutive two-week registration periods are payable. These extended benefits are available for days of unemployment on or after December 28, 2020. No additional days are available for registration periods beginning after September 6, 2021.

- Waiver of the seven-day waiting period for unemployment and sickness benefits. This was also extended to September 6, 2021.

In addition, ARPA provides that up to $10,200 in unemployment benefits may be exempt from income tax. This provision is administered by the IRS and they have more information here: New exclusion of up to $10,200 for unemployment benefits.

Finally, as you know, the Railroad Retirement Board’s (RRB)’s budget has remained flat for several years now and as a result, agency resources have been limited. ARPA provided a much-needed supplemental appropriation for the agency’s administrative budget. ARPA appropriated the remaining amount needed for the RRB’s multi-year IT modernization plan which will eventually provide more online services to railroaders and their families. In addition, it appropriated $6.8M for agency hiring related to the pandemic for the next two years. The RRB intends to hire staff in field service as well as in the unit at headquarters that handles sickness and unemployment applications. We hope that these additional hires will improve customer service.

As with previous legislation, the RRB has updated the information on its website with the details regarding these benefits. You can find the FAQs here: Coronavirus FAQs. Also, with most RRB field offices still closed to the public because of the pandemic, the agency is again reminding customers of the self-service options available to them to help avoid lengthy wait times. I encourage all railroaders to set up a myRRB.gov account on the RRB.gov website to help avoid any possible delays. To establish an account, employees should go to RRB.gov/myRRB and click on the button labeled SIGN IN WITH LOGIN.GOV at the top of the page. This directs them to login.gov where they will be guided through the process of creating an account and verifying their identity — which takes about 20 minutes to complete. Once an employee’s identity is verified, they will be prompted to sign in to their account and then return to myRRB.

Brothers and Sisters,

It has been one challenging year for us all and many of you have been hit extremely hard by COVID-19 – if not by the virus itself, by the impact it has had on the railroad industry. As you may have heard, Congress recently enacted legislation to provide some financial relief.

In the legislation entitled the Continued Assistance to Rail Workers Act of 2020, as outlined below, Congress essentially extended the benefits created by the CARES Act. In addition, Congress has finally granted some relief from sequestration – though not permanent. The legislation grants temporary relief from sequestration beginning 10 days from enactment through 30 days after the date on which the Presidential declaration of emergency for COVID terminates. This means that railroad employees will no longer have their regular unemployment and sickness benefits reduced for sequestration during the specified time period. In addition, the temporary relief is not retroactive to any earlier period of time.

Similar to the CARES Act, this legislation provides for the following benefits:

- A recovery benefit of $600 per two-week unemployment registration period. The duration is for registration periods from December 26, 2020, to March 14, 2021. This amount is down from $1,200 per registration period in the CARES Act.

- Extended unemployment benefits for employees who have otherwise exhausted benefits. These are payable for claims starting after enactment and on or before March 14, 2021. No extended benefits are payable after April 5, 2021.

- Waiver of the seven-day waiting period for unemployment and sickness benefits. This was also extended to March 14, 2021.

As with previous legislation, the RRB will update the information on its website with the details regarding these benefits.

In addition, the Railroad Retirement Board’s (RRB)’s budget for fiscal year (FY) 2021 has been finalized. In the annual funding legislation, Congress provided for $123.5 million in appropriations for the RRB, which includes $9M for IT investment initiatives. Unfortunately, the total amount provided remains the same as FY 2020, but there was a change of allocation. The amount allocated for IT investment initiatives was decreased from $10M for FY 2020 to $9M for FY 2021, which translates to an increase in the agency’s general administrative budget from $113.5M for FY 2020 to $114.5M for FY 2021. This $1M increase in the general administrative budget will help cover some of the annual cost increases that the agency anticipates.

As a reminder, the agency is still facing pressure from short-staffing in field service offices and at RRB headquarters. RRB is still experiencing high call volume due to COVID-19 related issues, and anticipates the annual spike in calls that generates through January of each year. Those calling the agency’s toll-free number in January commonly ask about income tax statements, which will be mailed out by January 19, 2021. The RRB will not accept requests for duplicate tax statements until February 1, 2021.

With most RRB field offices still closed to the public because of the pandemic, the agency is again reminding customers of the self-service options available to them to help avoid lengthy wait times. I encourage all railroaders to set up a myRRB.gov account on the RRB.gov website to help avoid any possible delays. Customers can request the following documents online by visiting RRB.gov/myRRB:

- Letters verifying income and monthly benefit rates

- Service and compensation statement

- Replacement Medicare card

- Duplicate tax statement (CY 2021 available after January 31, 2021)

In addition, railroad employees who have established myRRB accounts can log in and:

- Apply for and claim unemployment benefits

- Claim sickness benefits

- Check the status of their unemployment or sickness benefit claims

- View their railroad service and compensation history

- Get an estimate of retirement benefits

To establish an account, employees should go to RRB.gov/myRRB and click on the button labeled SIGN IN WITH LOGIN.GOV at the top of the page. This directs them to login.gov where they will be guided through the process of creating an account and verifying their identity — which takes about 20 minutes to complete. Once an employee’s identity is verified, they will be prompted to sign in to their account and then return to myRRB.

In closing, I would like to wish everyone in the rail community a healthy and happy 2021!

Railroad Retirement Board Labor Member John Bragg released the following message on Aug. 4:

Brothers and Sisters:

In my last update on July 9, 2020, I informed you of correspondence that the Railroad Retirement Board (RRB) received from the White House alleging that the National Railroad Retirement Investment Trust (NRRIT) was investing in companies which posed national security threats and raised humanitarian concerns. We were assured by NRRIT that it was not investing in these companies and that it has screening processes in place that identify those companies so that it does not and will not invest in them. Given the seriousness of the allegations, the RRB Board members assured the White House that a follow up with NRRIT would occur. The RRB Board Members sent a letter to NRRIT, again sharing some concerns, and followed up with a conference call on July 29th. NRRIT formally responded to the concerns raised in a letter dated July 30, 2020. That letter is attached for your viewing.

I want to reiterate that our trust fund is stable and NRRIT’s investments are producing the returns needed to ensure the stability of the fund well into the future. Every railroader has the right to retire with financial security and a sense of dignity. The RRB, with the help of NRRIT and its investments, helps ensure that right.

John Bragg,

Labor Member, Railroad Retirement Board

A letter issued from the Labor Member of the Railroad Retirement Board, John Bragg, addressed criticism by White House staff leveled toward RRB regarding investments in Chinese enterprises. Bragg’s response is reproduced below and links to supporting documentation are also available in the text below.

July 9, 2020

Brothers and Sisters:

As many of you may know, our retirement trust fund is one of the healthiest in the country. The National Railroad Retirement Investment Trust (NRRIT), manages and makes the investment decisions of the railroad retirement funds and to date has helped produce returns that secure our trust fund well into the future. NRRIT is an independent non-federal entity governed by a seven-member Board, with three selected by rail management, three selected by rail labor, and one independent trustee selected by the six rail trustees. The best interest of the trust fund and the security that it provides to the rail community is always at the forefront of their duties.

However, just this week, the Chairman of the RRB received a letter from Larry Kudlow, Director of the National Economic Council, along with National Security Adviser Robert O’Brien expressing concerns over NRRIT’s investment in Chinese companies. The letter alleged that NRRIT was investing in two Chinese companies specifically that pose an economic risk to the trust funds of railroad employees. NRRIT had already assured us last month that it did not hold any interest in the companies named in the letter.

Chairman Chorlé responded to the inquiry from Mr. Kudlow and Mr. O’Brien yesterday with the concurrence of Management Member Jayne and myself. I assure you that we, along with NRRIT, are taking the inquiry very seriously. A copy of the letter and our response is attached for your viewing.

John Bragg,

RRB Labor Member

From RRB Labor Member John Bragg:

In my last update, I explained that Phase 2 of the Railroad Retirement Board’s (RRB) CARES Act implementation plan was targeted for completion by the end of May. Phase 2 of the RRB’s plan provides for the additional $1,200 per registration period for claims beginning April 1, 2020, or later. I am happy to report that final testing is underway as I draft this message. Barring any unforeseen complications, we anticipate making the first payments under Phase 2 within a week. I am grateful for the commitment of RRB employees who have worked tirelessly to implement computer programming changes to issue these payments, in recognition that they are crucial to our brothers and sisters in the railroad community.

Example 1: A claimant receives a salary of $350 per month for serving as secretary-treasurer of the local lodge of his union. He performs a variety of duties at his own convenience while holding down a full-time railroad job in his craft. The average payment per day is not more than $15 and therefore it will likely be determined to be subsidiary remuneration. If the claimant is laid off from his full-time railroad job but still receives $350 per month union salary, he should contact the RRB to see if unemployment benefits may be paid to him.

Example 2: A claimant receives a salary of $500 per month for serving as secretary-treasurer of the local lodge of his union. He performs a variety of duties at his own convenience while holding down a full-time railroad job in his craft. The average payment per day is more than $15 and therefore it will likely be determined not to be subsidiary remuneration. If the claimant is laid off from his full-time railroad job but still receives $500 per month union salary, it is likely no UI benefits would be payable as UI benefits would only be payable if the amount he was paid for the union work was subsidiary remuneration.

Additional guidance on the effects of part-time work and whether the compensation paid for such work meets the definition of subsidiary remuneration can be obtained by contacting the RRB at 1-877-772-5772.

A message from John Bragg, the Railroad Retirement Board’s labor member, released this week stated that the increased $1,200 in unemployment benefits from the CARES Act will begin to be deposited toward the end of the month.

“We do not have an implementation date as of yet, but barring unforeseen complications, (we) hope to have Phase 2 completed by the end of the month,” Bragg stated. “Our team is working on the necessary programming changes to provide for those payments.”

The payment of the additional $1,200 biweekly per registration period for unemployment claims beginning April 1, 2020, or later will be paid retroactively to April 1 once the necessary adjustments are made to the RRB’s system.

“I assure you that agency employees recognize the lifeline that these benefits represent for the railroad community and all appropriate resources are being directed towards completing this work as soon as possible,” Bragg said.

The first phase of CARES Act unemployment assistance for rail workers required RRB to identify all employees who exhausted their regular UI benefits during the benefit year that began July 1, 2019, establish new extended UI periods and lengthen existing extended UI benefit periods as appropriate and pay any denied days of unemployment already on record.

RRB also sent UI claimants a letter of the payment actions and mailed any needed claim forms to bring claimants current so they can continue to receive the extended benefits. For those who file their claims electronically, the RRB loaded appropriate claim forms to their online accounts so that individuals can file them online through myRRB on the website RRB.gov.

Read an earlier release from RRB about the CARES Act unemployment benefits.

I wanted to send out another update on what is going on at the agency. We have received inquiries regarding Pandemic Unemployment Assistance (PUA) that was established under the CARES Act and whether railroaders may be eligible for benefits under that program if they are not eligible for Railroad Unemployment Insurance Benefits (RUIA) benefits. The Department of Labor (DoL) is responsible for giving guidance to the states regarding the PUA benefits, so we asked the Railroad Retirement Board’s (RRB) General Counsel to reach out to the DoL. The RRB’s General Counsel has been advised by the DoL that nothing in the PUA provisions prohibit railroaders from being eligible for these benefits if they otherwise qualify. Similarly, the RRB’s General Counsel has found that there is nothing in the RUIA that prohibits railroaders from receiving PUA benefits if they are not receiving RUIA benefits. So as a result, I would recommend that if your members have been denied RUIA benefits, they check with their state unemployment services to see if they are eligible for PUA benefits. To find out the application process in each state, you can refer workers to the Unemployment Benefit Finder at the following website:

https://www.careeronestop.org/LocalHelp/UnemploymentBenefits/Find-Unemployment-Benefits.aspx.

Though not related to COVID-19, I wanted to inform you of a new hire at the RRB. As you may remember from previous updates, the Board has been trying to hire a Chief Medical Officer. A new CMO, Dr. Elizabeth Bonson, has been hired and starts today. We hope that the CMO’s presence at the agency will help make the disability process more efficient.

Finally, as you know, the RRB is located in Chicago and this week, the governor of Illinois extended the stay-at-home order through May 30. I anticipate that the agency headquarters will continue to primarily work remotely. Regarding the field offices, although not all states have the same limitations as Illinois, at present it is my recommendation that it is in the best interests of agency personnel and the railroad population we serve to maintain the current work environment for all offices. Consequently, for the time being, field offices will remain closed to the public and staff will work remotely with periodic visits to the office for administrative tasks.

John Bragg,

Labor member, Railroad Retirement Board