Each year, the U.S. Railroad Retirement Board (RRB) prepares a Form BA-6, Certificate of Service Months and Compensation, for every railroad employee with creditable railroad compensation in the previous calendar year. The RRB will mail the forms to employees during the first half of June. Anyone with compensation reported in 2022 who has not received Form BA-6 by July 1, or who needs a replacement, should contact an RRB field office by calling toll-free at 1-877-772-5772. A statement can also be requested online by clicking the “Request Documents” button at RRB.gov/myRRB, or by using the toll-free number’s automated menu at the end of the recorded greeting to request a statement of service months and compensation.

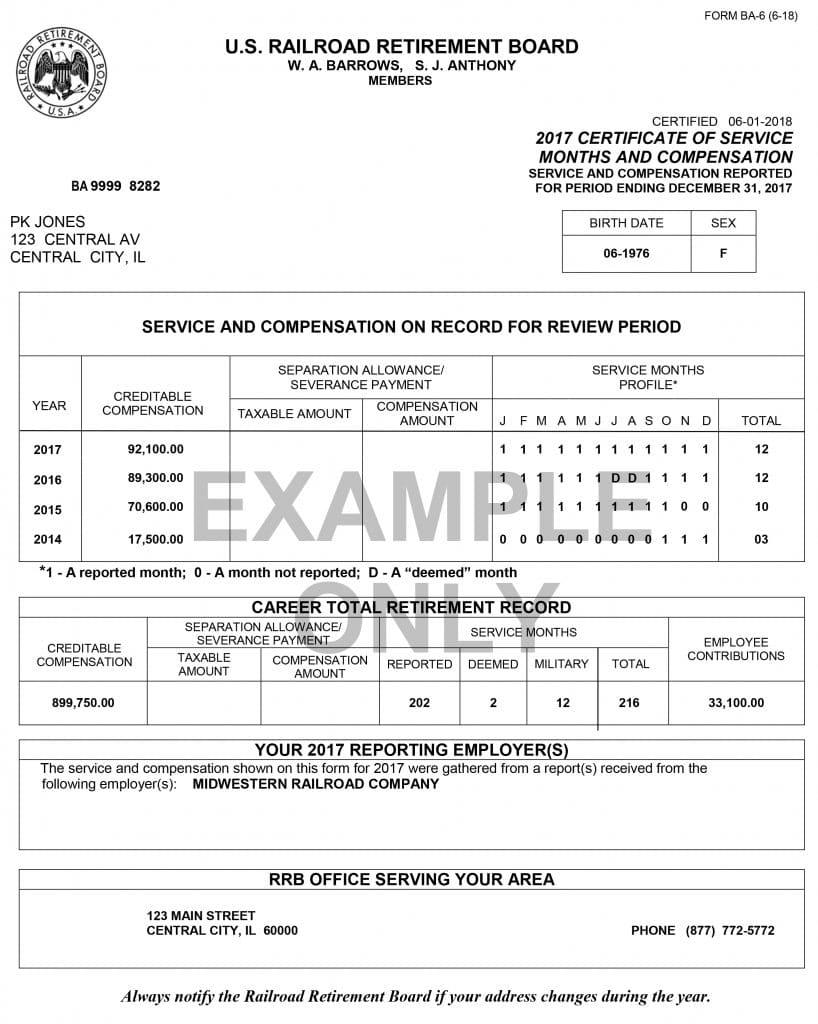

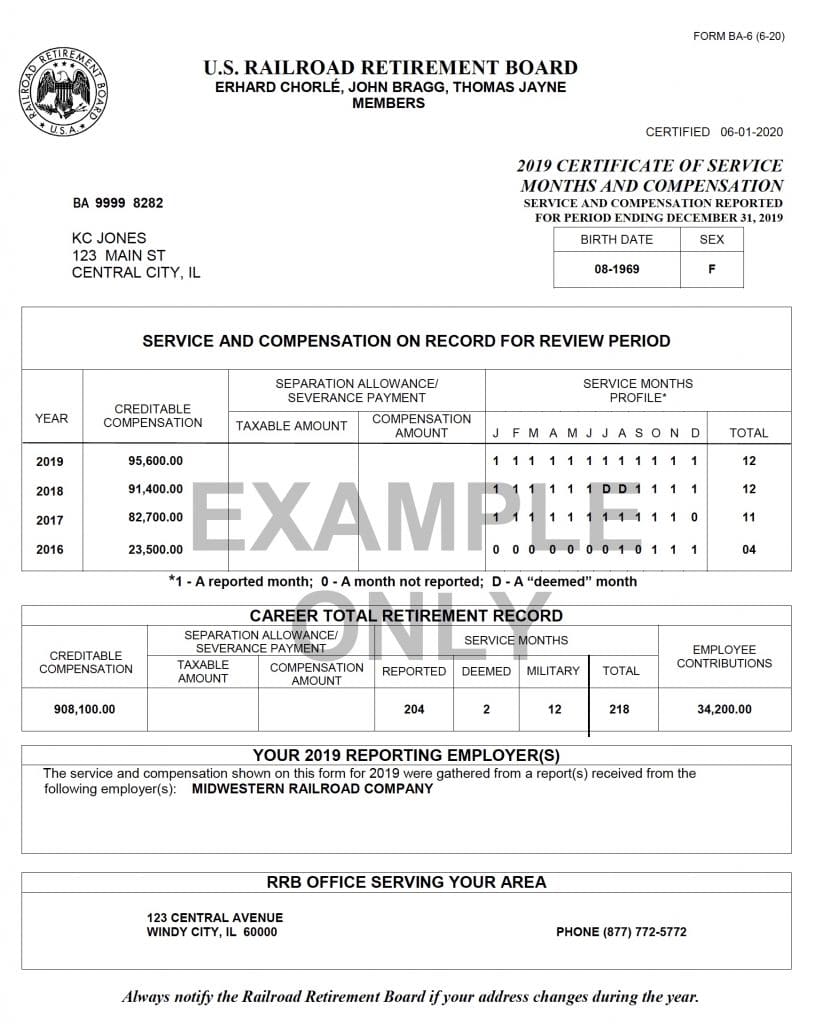

Form BA-6 provides employees with a record of their Railroad Retirement service and compensation. The information shown is used to determine whether an employee qualifies for benefits and the amount of those benefits; therefore, it is important that employees review their Form BA-6 to see whether their own records of service months and creditable compensation agree with the form.

When reviewing the 2022 compensation total, employees should be aware that only annual earnings up to $147,000 are creditable for Railroad Retirement purposes in that year, and that $147,000 is the maximum amount shown on the form. In addition, the form shows service credited on a month-by-month basis for 2021, 2020, and 2019, when the maximum creditable compensation was $142,800, $137,700, and $132,900, respectively. The BA-6 also lists the employer(s) reporting the employee’s 2022 service and compensation.

Besides the months of service reported by employers, Form BA-6 shows the number of any additional service months deemed by the RRB. Deemed service months may be credited under certain conditions to an employee who did not work in all 12 months of the year, but had creditable Tier II earnings exceeding the monthly proration of the creditable Tier II earnings maximum for the year. However, the total reported and deemed service months may never exceed 12 in a calendar year, and no service months (reported or deemed) can be credited after retirement, severance, resignation, discharge or death.

The BA-6 form also indicates the number of months of verified military service creditable as service under the Railroad Retirement Act if the service was previously reported to the RRB. Employees are encouraged to submit proofs of age and/or military service in advance of their actual retirement. Filing these proofs with the RRB in advance will streamline the benefit application process and help prevent payment delays.

For employees who received separation or severance payments, the section of the form designated “Taxable Amount” shows the amounts of separation allowance or severance payments that were subject to Railroad Retirement Tier II taxes. This information is shown on the form because a lump sum, approximating part or all of the Tier II taxes deducted from such payments made after 1984, which did not provide additional Tier II credits, may be payable by the RRB upon retirement to qualified employees or to survivors if the employee dies before retirement. The amount of an allowance included in an employee’s regular compensation is shown under “Compensation Amount.”

Form BA-6 also shows, in the section designated “Employee Contributions,” the cumulative amount of Tier II Railroad Retirement payroll taxes paid by the employee over and above Tier I Social Security equivalent payroll taxes. While the RRB does not collect or maintain payroll tax information, the agency computes this amount from its compensation records in order to advise retired employees of their payroll tax contributions for federal income tax purposes.

In the lower-right corner of the form, there is a field that indicates if the employee is eligible to claim unemployment or sickness benefits. The RRB provides detailed instructions for reviewing the form on the agency website at RRB.gov/BA6.

There are instructions on the back of the form and the web page on how to file a protest if service and compensation totals are incorrect. The law limits to four years the period during which corrections to service and compensation amounts can be made. Also, if personal information is incorrect or incomplete, such as the name, birthdate, or address, the employee should contact an RRB field office to have it corrected. For most people, the address of the RRB office serving their area is provided on the form along with the RRB’s nationwide toll-free number (1-877-772-5772).

Each year, the U.S. Railroad Retirement Board (RRB) prepares a “Certificate of Service Months and Compensation” (Form BA-6) for every railroad employee with creditable railroad compensation in the previous calendar year. The RRB will mail the forms to employees during the first half of June. While every effort has been made to maintain current addresses for all active railroad employees, anyone with compensation reported in 2018 who has not received Form BA-6 by July 1, or needs a replacement, should contact an RRB field office by calling the agency toll-free at 1-877-772-5772.

Each year, the U.S. Railroad Retirement Board (RRB) prepares a “Certificate of Service Months and Compensation” (Form BA-6) for every railroad employee with creditable railroad compensation in the previous calendar year. The RRB will mail the forms to employees during the first half of June. While every effort has been made to maintain current addresses for all active railroad employees, anyone with compensation reported in 2018 who has not received Form BA-6 by July 1, or needs a replacement, should contact an RRB field office by calling the agency toll-free at 1-877-772-5772.